Experts you can count on when you need it most

Gibbins Advisors is a leading restructuring and transformation firm specializing in middle-market healthcare.

We help healthcare organizations and their stakeholders—whether lenders, creditors or investors—stabilize finances, overcome complex challenges, and strategically position for long term success.

Navigating Complexity with Confidence

We are called in when businesses confront complex challenges that need our seasoned expertise, tactful approach and tailored solutions.

Clarity

We find the best path in complex scenarios by pinpointing critical issues and options.

Creativity

Strategic, nimble, and results-

driven — we craft innovative and customized solutions to achieve your goals.

Execution

We lead and collaborate with stakeholders at all levels, building buy-in to deliver lasting results.

Our Services

We support clients through complex financial and operational challenges with services that include:

-

Comprehensive support through financial distress, tight liquidity, strategic pivots, stakeholder negotiations, and turnaround situations—for both in-court and out-of-court restructurings.

-

Hands-on leadership and practical solutions to improve performance, manage change, and guide organizations through transitions or crisis.

-

Strategic and practical advice to enhance recovery and mitigate risk for lenders, bondholders, trade vendors, general unsecured creditors, and committees navigating distressed debtors.

-

Serving as Trustee, Administrator, Receiver, or Monitor in complex healthcare cases—with the skill and independence that courts and stakeholders trust.

-

Decision-making and execution support for acquisitions, divestitures, wind-downs, and complex change initiatives.

-

Independent analysis, expert testimony, and investigative insight in financial and operational disputes.

Middle Market Focus

We work across the U.S. and Australia, supporting healthcare organizations in the middle market (revenues of ~$30M–$500M) across public, private, and not-for-profit ownership models.

Private, PE-backed and Publicly Traded

Not-for-profit

Governmental and Healthcare Districts

-

General acute care

Critical Access

Long Term Acute

Behavioral Health

Specialty hospitals

-

Nursing homes

Skilled nursing facilities

Home care

Hospice

Inpatient Rehabilitation

Addiction Centers

-

Assisted living

Independent living

Memory Care

Continuing Care Retirement Communities (CCRCs)

-

Specialty group practice

Primary care

Dental

Urgent care centers

Ambulatory surgery centers

Freestanding ER facilities

-

Therapy

Laboratory

Pharmacy

Imaging

Staffing

DME

Revenue cycle providers

Corporate services

Medical office buildings

REIT and medical property

-

Higher Education

Social Services

Pension and OPEB (Other Post-Employment Obligations)

Charitable organizations

Religious organizations

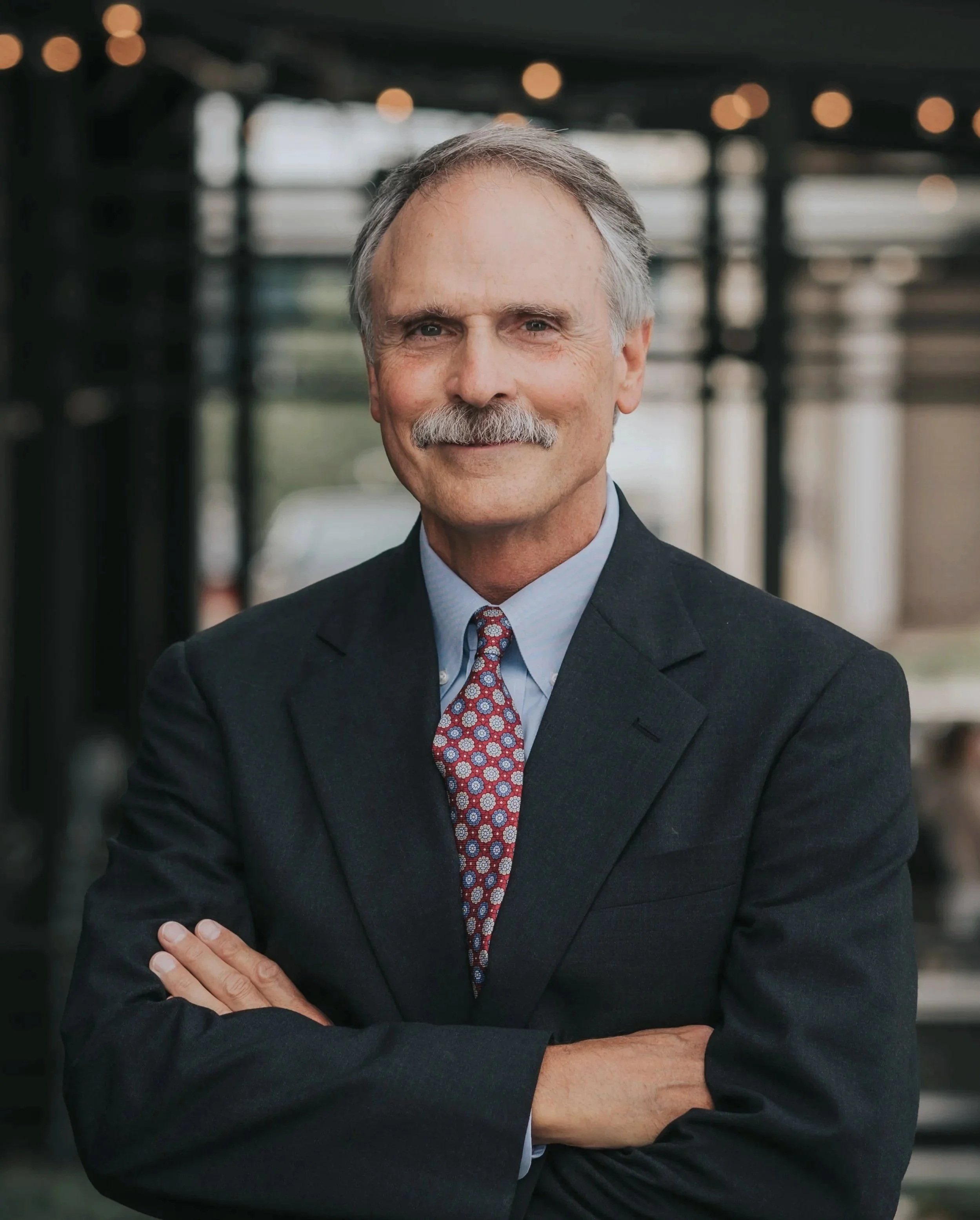

Our Team

The expertise of our people is the strength of our business

Recognized for Excellence in Healthcare Advisory

Gibbins Advisors received the M&A Advisor Award for Healthcare/Life Sciences Deal of the Year (Under $1B) for the successful Chapter 11 reorganization of Tabor Manor Care Center. The outcome preserved jobs, secured financial stability, and kept access to vital long term care services in the Iowa community.

Latest Research: Healthcare Restructuring

Gibbins Advisors tracks Chapter 11 filings in the Healthcare and Medical sector ($10M+ liabilities), offering quarterly insights by size and sub-sector. Read our latest report for trends, drivers, and strategic guidance.

Latest media

Experience in Action

Practical examples showcasing how we have helped clients achieve clarity, stability, and sustainable outcomes.

Delivered a successful out-of-court wind down of physician practices

Trusted Insights, Recognized Expertise

Recognized as a trusted voice in the field, Gibbins Advisors is regularly quoted in leading publications.

Subscribe

Get the latest insights and analysis from

Gibbins Advisors