Optimized value to physician owners in successful sale

One of the largest primary care group practices in the Northeast.

Gibbins Advisors supported the business over an 18 month period in its valuation, off-market recapitalization process with JV partner and ultimate successful sale to a major health insurer.

TEAM Ronald Winters, Mark Beckett

Situation Overview

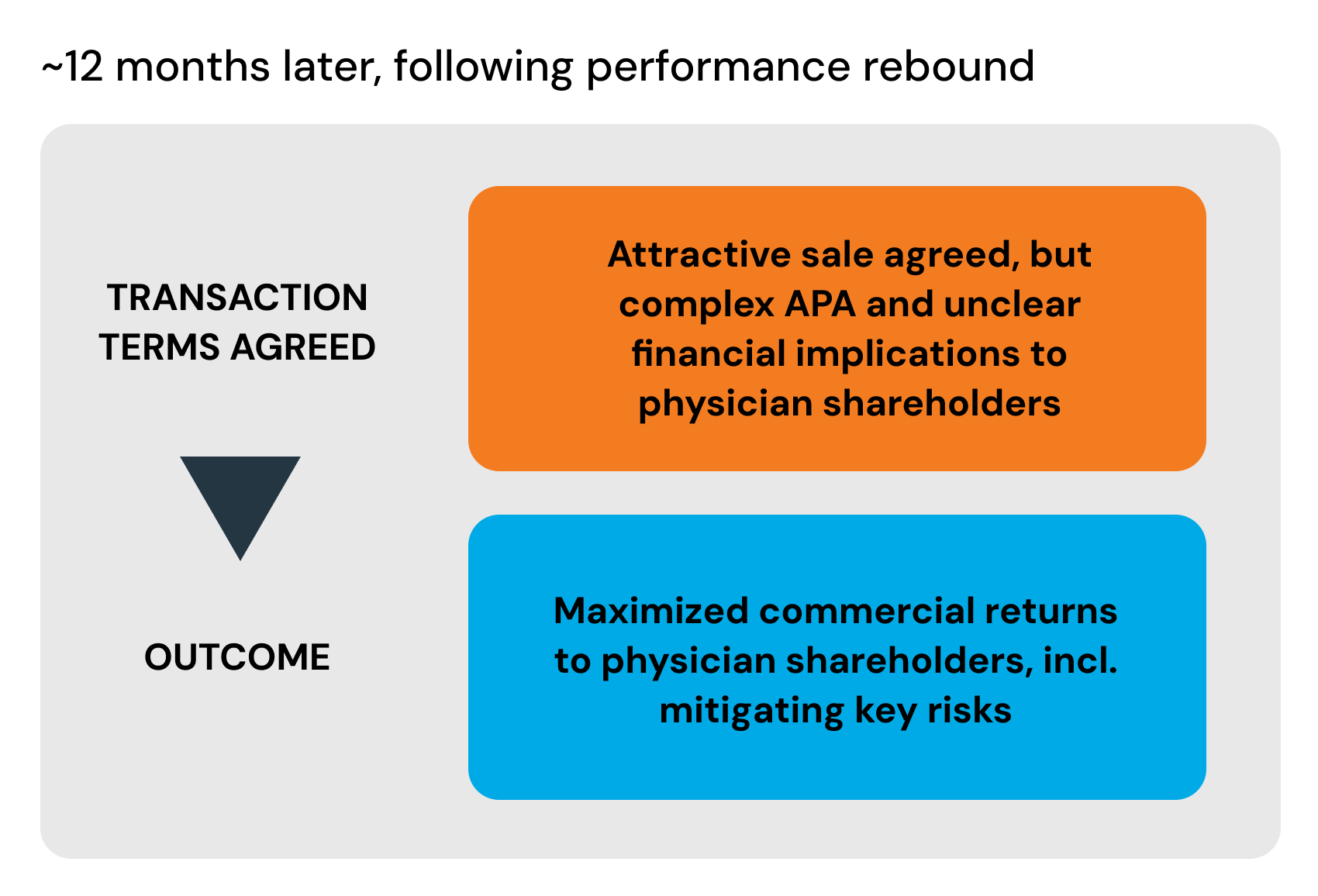

A 400+ physician group faced capital constraints during COVID-19, requiring recapitalization with its joint venture (JV) partner. After a rebound in performance, the group elected to pursue a strategic transaction.

Images are for illustrative purposes only.

Summary

Sector:

Large primary care physician group

Approx. Size:

400+ doctors

Our role:

Phase 1 – Enterprise forecasts and valuation.

Phase 2 – Recapitalization with JV partner.

Phase 3 – Advising on enterprise sale to major insurer

Key Results

Successful recapitalization

Profitable sale to large insurance provider and deal structured to optimize value to doctors.

Role

Engaged by physician shareholders over an 18-month period (2020–22) to maximize commercial outcomes as circumstances evolved in a volatile COVID-19 environment.

Financial Preparation: Reviewed and stress-tested forecasts to support enterprise valuation.

Recapitalization Negotiation: Guided discussions with the corporate JV partner to enhance shareholder outcomes.

Strategic Transaction Support: Assisted in evaluating sale options, securing a favorable transaction with a major health insurer.

Transaction Execution: Advised the board and company on maximizing sale consideration, managing closing adjustments, and mitigating risks impacting shareholder value.

Approach

Commercial Insight: Identified and stress-tested key business drivers.

Advisor Collaboration: Worked constructively with legal counsel and JV partners, providing input on complex documentation and negotiations.

Stakeholder Engagement: Delivered regular board and shareholder updates, fostering alignment throughout the process.

Key Accomplishments

Achieved alignment on enterprise valuation between JV partners during a rapidly evolving COVID-19 environment.

Navigated a complex stakeholder landscape involving multiple shareholder groups, JV partners, purchasers, and advisors.

Protected client interests and maximized commercial returns to physician shareholders.